An Uber-challenge to automobile insurance coverage

Using the family car to drive for Uber carries the potential for serious consequences in terms of inadequate insurance protection. Until the legal issues surrounding Uber’s business model are resolved, it doesn’t appear likely the industry will come up with a solution.

Uber is a large multinational firm that offers consumers an alternative to licensed taxis. Instead to relying on a traditional taxi service, consumers are able to arrange a ride using a mobile application. Under the terms of service, the consumer is picked up and taken to their chosen destination by a driver who is using his or her own car. Because it operates outside the taxi licensing framework and because it does not operate its own fleet of vehicles, Uber’s operating costs are lower than those of a regular taxi company. Uber therefore represents a significant challenge to traditional taxi and limousine services.

As noted by The Toronto Star, since setting up shop in Toronto in March 2012, Uber has ‘firmly insisted it is not a taxi company, but rather a technology company, therefore not subject to licensing rules‘. The City of Toronto does not agree with Uber’s stance and has announced it will argue the case in court. Uber faces several dozen charges of violating City of Toronto bylaws. Tracey Cook, the city’s executive director of municipal licensing and standards has been quoted as saying Uber is operating in ‘flagrant disregard’ of municipal and provincial laws. For his part, Toronto’s new mayor, John Tory, has taken the view that this new technology is here to stay and that it is the laws that need to be adjusted.

While Uber’s various legal challenges wend their way through the courts and as politicians grapple with the question of whether taxi regulations need to be modified, the drivers who are using their own private passenger cars to pick up and drive Uber’s customers to their destinations may find they are doing so without the benefit of their own insurance.

Except for certain Accident Benefits coverage, Section 1.8.1 of the Ontario Automobile Policy stipulates there is no coverage under an Owner’s Policy if an automobile is used as a taxicab or to carry paying passengers. This means there is no coverage under Section 3 (Liability Coverage), Section 6 (Direct Compensation – Property Damage Coverage), or Section 7 (Loss or Damage Coverages).

One of the relatively few yes/no questions on an Ontario automobile insurance application asks whether any of the described automobiles will be used to carry passengers for compensation or hire. Even if the insured can truthfully say ‘no’ at the time of application, if he or she subsequently starts driving passengers for Uber, the wording of an automobile insurance policy requires the insured to promptly notify the insurer of any material change in risk. Given that carrying passengers for compensation is one of the few questions asked on an automobile insurance application, it is reasonable to assume that the courts will view the carrying of passengers for compensation as a material underwriting fact. Not only would this allow an insurer to deny a claim, it would also be grounds for cancelling a policy altogether. Knowingly misrepresenting or failing to disclose a material fact is one of the few events that allows an insurer to cancel automobile insurance coverage mid-term.

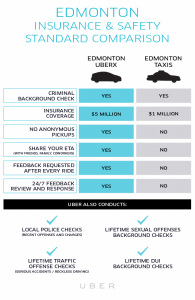

On its Canadian website, Uber highlights the fact that every ride on the uberX platform in Canada is ‘backed by US$5,000,000 of contingent auto liability insurance’. In the event of an accident, this coverage is available for the benefit of ‘passengers, pedestrians, other drivers, and the community at large’ who will all be ‘well covered by commercial auto insurance in addition to any insurance coverage maintained by the driver’. Conspicuous by its absence is any mention of bodily injury or physical damage coverage for the driver.

As mentioned above, the Ontario Owner’s Policy does provide ‘certain Accident Benefits coverage’ if an insured automobile is used to carry passengers for compensation. Beyond that, there is no bodily injury or physical damage coverage. If the vehicle itself is damaged, the loss payee would be covered to the extent of the unpaid portion of a car loan. The owner’s equity in the vehicle would not be covered.

These are significant coverage issues faced by policyholders who allow their insurance vehicle to be used to ferry passengers around for Uber. Doubtless many policyholders are engaging in this activity under the blissful assumption that full coverage is in place should anything go wrong. This looks like a dangerously faulty assumption.

Until these coverage issues are resolved, some brokerages may consider alerting their automobile insurance customers at renewal. Granted, the vast majority of customers will be unaffected. Still, the few customers who are affected will appreciate the heads-up. Waiting until a claim occurs before mentioning policy restrictions is never a reliable path to customer satisfaction.

The problem at the moment, of course, is that there isn’t a coverage solution at hand. Until the legal/regulatory issues surrounding Uber’s business model are sorted out in the courts and by politicians, it is problematic for the insurance industry to offer coverage to drivers for an activity that may or may not be in compliance with the law. If the day comes when these issues are addressed in Uber’s favour, this will open the door for the industry to offer full coverage through a combination of endorsements and premium charges. In the meantime, Uber’s drivers appear to be in coverage limbo.

Post Contributor by Canadian Underwriter - Author Peter Morris